KUALA LUMPUR 3 August - Sunway REIT Management Sdn. Bhd., the Manager of Sunway Real Estate Investment Trust (Sunway REIT) has proposed to acquire The Pinnacle Sunway for a total purchase consideration of RM450 million and to raise up to RM710 million.

The proposed acquisition will be done via a private placement to fund the proposed acquisition as well as the expansion of Sunway Carnival Mall.

``Upon the completion of the proposed acquisition, Sunway REIT’s property value will increase to RM8.5 billion, reinforcing its position as the 2nd largest listed REIT in Malaysia,'' said the company in a statement announcing its financial year result, today.

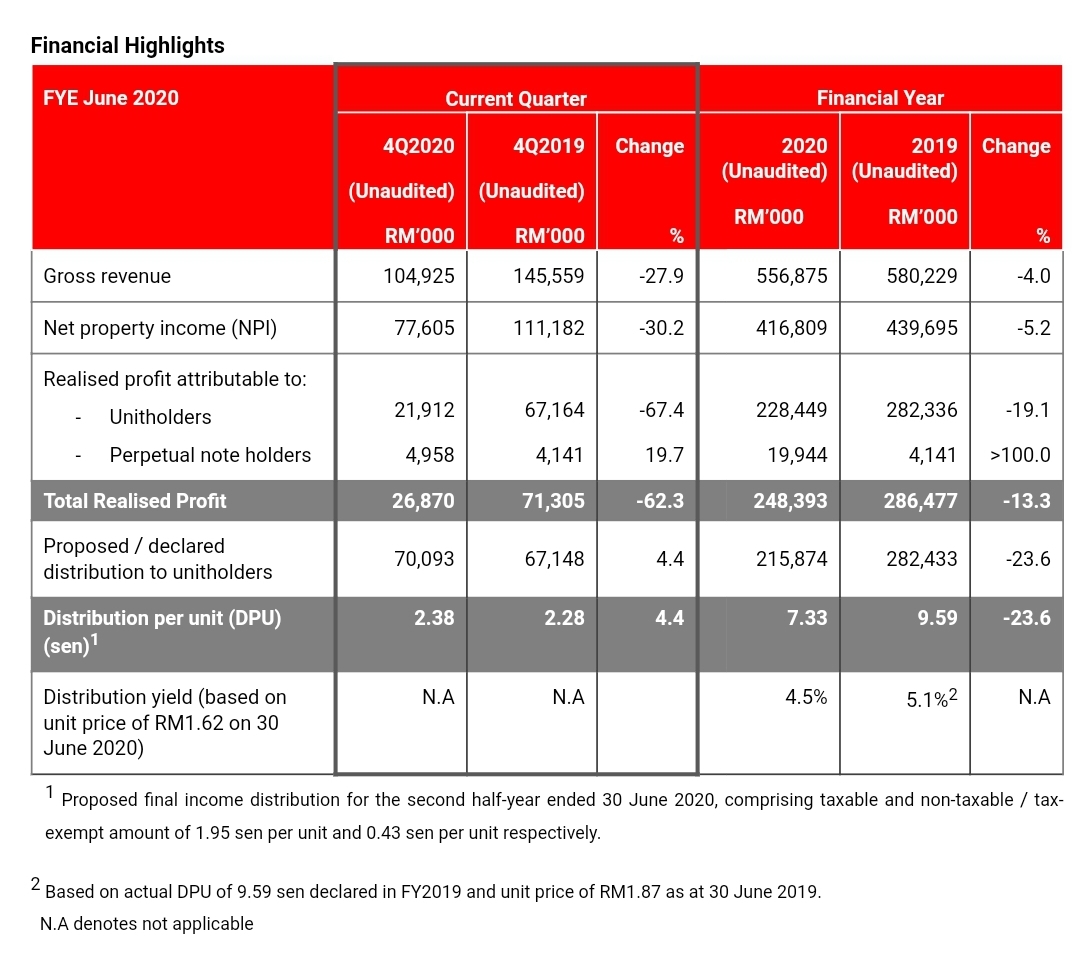

Sunway REIT recorded revenue and net property income of RM556.9 million and RM416.8 million respectively in FY2020, largely contributed by the improved performance across all segments for the first half of FY2020, before the performance of the retail and hotel segments were impacted by the COVID-19 pandemic and MCO in the second half of FY2020.

For the financial year ended June 2020, the retail segment recorded a revenue and NPI of RM364.7 million and RM248.5 million respectively. The retail segment recorded a modest growth in the first half of FY2020, however, the trend reversed in the second half of FY2020 due to COVID-19 outbreak since 3Q FY2020. The reversal in earnings trend has resulted in a revenue and NPI contraction of 14.5% and 19.9% respectively.

The financial performance for the hotel segment ended lower in FY2020 on the back of challenging operating environment which was further exacerbated by COVID-19 pandemic and business restrictions imposed on the hotel sector. Revenue for the hotel segment eased 12.8% to RM68.5 million with a corresponding NPI of RM62.3 million, or 12.7% lower compared to FY2019.

The office segment registered a healthy growth in FY2020, largely underpinned by better performance across all office properties in the asset portfolio. Revenue for the office segment rose by 8.5% to RM41.7 million and NPI improved by 12.2% to RM24.0 million.

The services segment enjoyed a jump in revenue and NPI in FY2020, benefitting from the full year income contributed by Sunway university & college campus and annual rental reversion for Sunway Medical Centre (Tower A & B). Both revenue and NPI soared by 92.2% to RM58.9 million in FY2020.

Meanwhile, the industrial & others segment recorded a moderate growth of 4.8% in revenue and NPI to RM6.2 million in FY2020.

Sunway REIT proposed a final distribution per unit (DPU) of 2.38 sen for the 6-month period ended 30 June 2020, bringing total DPU to 7.33 sen in FY2020. Based on the unit price of RM1.62 as at 30 June 2020, this translated into a distribution yield of 4.5%.

CEO of Sunway REIT Management Sdn. Bhd., Datuk Jeffrey Ng commented, “We are seeing encouraging recovery in footfall to our malls since RMCO.

"The business units management teams have also recently launched “Ke Sana Ke Sini Ke Sunway” campaign, a leisure package which was fully sold within 2 weeks of launch. Due to the overwhelming response, a sequel of the campaign was launched, “Ke Sana Ke Sini Ke Sunway Lagi".

"These campaigns, which aim to capture the short-term surge in demand amongst consumers following a period of lockdowns, demonstrated the strength of business synergies within the Sunway City ecosystem," he said.

He added, “In times of uncertainties, we have implemented prudent cost management and cash conservation initiatives as pre-emptive measures to ensure sufficient flexibility in our liquidity management. As part of the cash conservation initiative, we are in the process of establishing a Distribution Reinvestment Scheme (DRS) to provide the additional flexibility to unitholders to receive future income distribution in cash, units or a combination of both.”

On the future prospects, he also shared, “Sunway REIT maintains a cautious outlook in FY2021 due to the uncertainties surrounding global economic recovery, and will focus on rebuilding the business segments that have been adversely impacted by the pandemic while strengthening its balance sheet and expanding the income stream via yield-accretive acquisitions and prudent capital management strategies.”

Sunway REIT, through its active participation in the Malaysian REIT Managers Association (MRMA), has collectively proposed COVID-19 relief measures to the Government and regulatory bodies in relieving the burden of M-REITs and unitholders during this challenging period.

The highlight of the proposal includes waiver of withholding tax for resident individual unitholders. The proposal will be a milestone for the REIT industry in Malaysia and positive for capital market development in the country. - DagangNews.com