By ZAIDI ISHAM ISMAIL

editor@dagangnews.com

KUALA LUMPUR Oct 1 - Berjaya Corp Berhad, like many other firms are affected by COVID-19. Due to the lockdowns, there are few shoppers who flock to Berjaya Times Square or spend their holidays at BJCorp-owned hotels such as in Bukit Tinggi and Tioman island.

So naturally it was a pleasant surprise for investors on Wednesday when the company narrowed its losses to RM242 million in fourth quarter ended June from RM327 million in the comparable quarter last year.

The question now is, can the company especially its new chief executive officer Abdul Jalil Rasheed cut its losses further and return to profitability as soon as possible?

The corporate sector was abuzz a few months ago with the appointment of Jalil as BJCorp's new chief executive officer.

Jalil's ascension was unprecedented of sorts as this was the first time that an outsider of the Tan family (Berjaya Group founder Tan Sri Vincent Tan) was appointed.

All was hunky dory at the time and the market reacted favourably to the news which saw BCorp's share price hitting the roof, its highest in so many years.

But the road ahead will be challenging to the group as BCorp turned in a net loss of RM242 million in the quarter ended June 2021.

To be fair, the company's losses were due to impairments.

"Jalil will have his work cut out for him to turn around the company amid this pandemic," a fund manager at Permodalan Nasional Berhad told DagangNews.com.

He added that it will be tough for him to do anything about the hotel and food and beverage sector due to COVID-19.

"But the numbers forecast (gaming) sector meanwhile will slowly pickup as consumer confidence returns due to the rebounding economy.

"But things might pick up in the next few months as most states have entered phase three of the national recovery plan.

The hotel and food and beverage sector might pick up in the next few months," said the analyst.

Another aspect that Jalil has to look into is the low liquidity of its shares.

As announced by the firm last week that Bursa had given the firm time extension on floating more of its shares to investors by December.

"BCorp is already seen as a defensive stock meaning not many of its shares are publicly traded.

It is also seen as a family empire owned and run by Vincent Tan.

"Thus it has to shed its image as a family-owned business empire by making more of its shares available to the public.

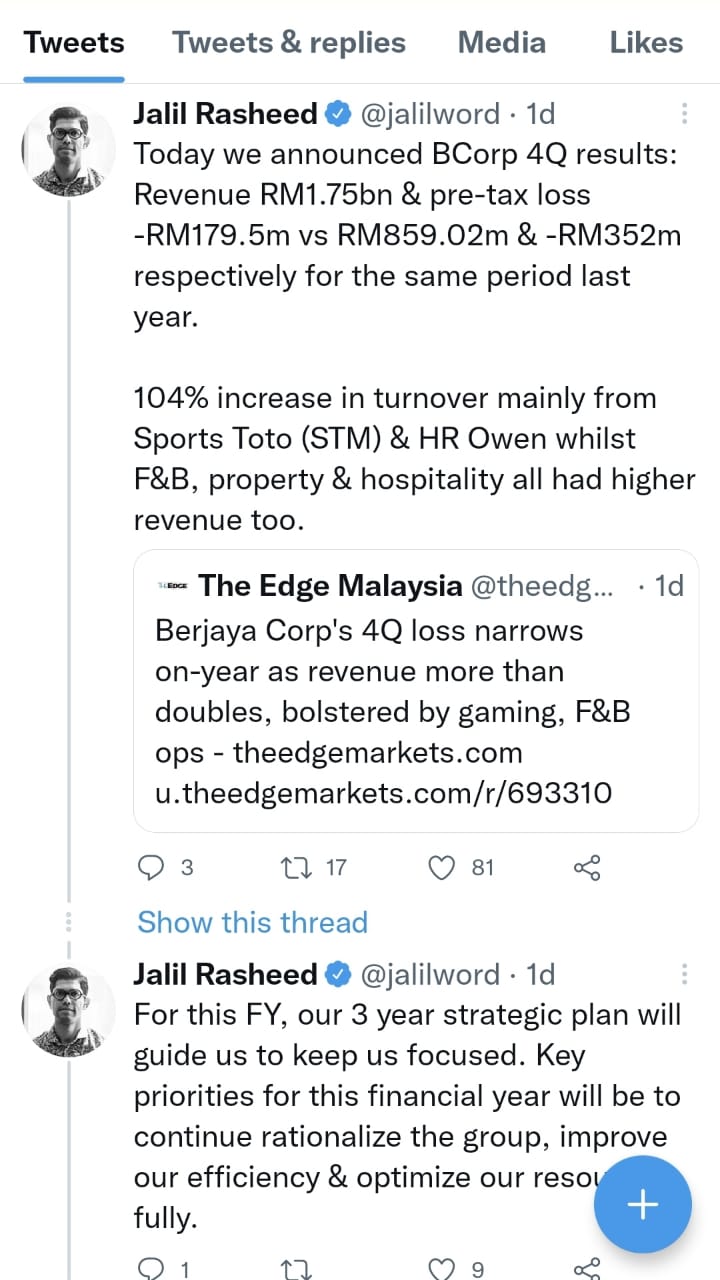

Jalil took to Twitter yesterday and said that BJCorp will focus on three areas — rationalisation of the group, improving its efficiency and optimising its resources fully — for the current financial year ending June 30, 2022.

It will be a gargantuan challenge but it is up to Jalil now on whether he can turn around BJCorp.

The investor and the Tan family are watching his every move. - DagangNews.com