WEEKLY MARKET ANALYSIS BY MANOKARAN MOTTAIN

THE benchmark KLCI Index ended the week lower at 1,399.70 points (-12.03 points or -0.85%) as the local stock market continues to be buffeted by volatility brought about by concerns over the US and European banking sectors.

The average daily value traded fell by 28% on a weekly basis to RM1.92 billion per day from RM2.66 billion per day in the week before as traders and investors alike took money off the table to await better news flow. This caused last week’s trading value to come in 9% below the past 100-day average daily trading value of RM2.11 billion per day.

In the bond market, US bond yields continued to fall across the entire yield curve despite the US Federal Reserve raising the benchmark Federal Funds Rate by 25 basis points to a target range of between 4.75% to 5.00% as investors digested the latest outlook on interest rates by the US Federal Reserve.

Federal Reserve Chairman Jerome Powell said policy decisions on interest rates would be data dependent going forward but the Federal Reserve is unlikely to cut rates in 2023 as inflationary pressures and the labor market remained robust. Projections pointed to a peak interest rate of 5.1% indicating that there is potentially only one more rate hike coming up.

The US Federal Reserve also increased their 2023 inflation forecast to 3.3% from 3.1% while the outlook for 2023 and 2024 GDP were revised lower to 0.4% and 1.2% respectively.

The 10-year US Treasury (UST) yields ended the week 7 basis points lower at 3.37% from 3.44% in the previous week. This increased the total yield gains over the past 30 weeks to just 33 basis points.

The UST 2-year yields dropped by a further 9 basis points lower to 3.76% from last Friday’s close of 3.85%. This extends the yield curve inversion between the UST 2-year and 10-year notes into its 37th consecutive week but yield spreads have narrowed further to -39 basis points from -41 basis points last week. The long-term average of the yield spread for both UST is +0.92% or +92 basis points.

MGS bond yields also fell in response to the fall in the UST yields. The 10-year MGS bond yields fell by 12 basis points to 3.87% from 3.99% last Friday to narrow the yield spreads between both countries’ 10-year bonds to 50 basis points from 55 basis points last week.

ECONOMICS

Malaysia’s Consumer Price Index (CPI) for February 2023 rose 3.7% on a year-on-year (y-o-y) basis while core inflation also rose 3.9% y-o-y. The increase in the CPI was primarily due to strong hikes in the restaurants & hotels (+7.4%), food & non-alcoholic beverages (+7.0%) and the transport (+3.7%) segments.

Works Minister Datuk Seri Alexander Nanta Linggi has disclosed that a new toll open payment system will be implemented on five (5) highways by September 2023. The highways are the Sungai Besi Highway, Baru Pantai Highway, Ampang-Kuala Lumpur Elevated Highway, Guthrie Corridor Highway and the Penang Bridge.

Highway users can start using their debit and credit cards for toll payments under the new open payment system. He added that the federal government will also be conducting a proof of concept for the Multi Lanes Free Flow system before the end of October 2023 to evaluate the system.

The Ministry of Finance has announced that the excise duty on pre-mixed products that have a sugar content of over 33.3 grams / 100 grams, service tax on the delivery of goods and a sales tax on low value goods has been delayed to a later date. The decision was made after taking into consideration the feedback from the Micro, Small and Medium enterprises on the need for more time to prepare for their full implementation. It added that the delay would also allow the government extra time to refine the legal aspects of the three tax initiatives for smoother implementation.

Khazanah Nasional Berhad announced a higher profit of RM1.6 billion in 2022 as compared to RM670 million in 2021 due to lower impairment and monetisation activities. Meanwhile its debt increased marginally to RM49.1 billion in 2022 from RM48.5 billion and its Realisable Asset Value over debt ratio remained at 2.7x.

However, its Net Asset Value fell to RM81 billion in 2022 from RM86 billion due to global market volatility. In 2022, it deployed RM6.6 billion into new investments and raised RM2.5 billion from monetisation of assets. It gave a dividend of RM500 million to the federal government last year.

CURRENCY

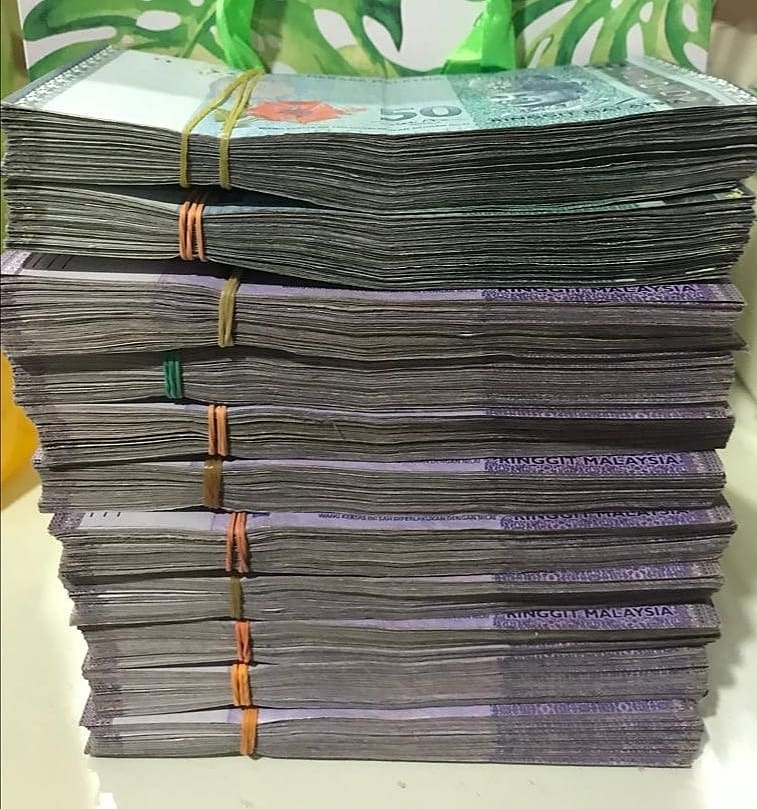

The Ringgit continued to rally against all the major currencies last week as the cautious sentiment in the equity and bond markets continues. The Ringgit ended the week much stronger against the US Dollar at RM4.4260 / USD1.00 (-5.70sen).

The Ringgit also gained against the British Pound at RM5.4050 / GBP1.00 (-5.45sen), the Singapore Dollar at RM3.3214 / SGD1.00 (-2.42sen), the Euro at RM4.7615 / EUR1.00 (-2.20sen) and the Japanese Yen RM3.3860 / JPY100 (-0.5sen).

MY OPINION

Volatility in the local stock market is likely to continue in the coming week as fears of a global financial crisis lingers on as concerns now shifted to European banks whose shares have come under heavy selling pressure due to a sudden and sharp rise in their credit default swaps.

Nevertheless, the KLCI Index managed to hang onto its key support level of 1,400 points and it raises hopes of a rebound in the near term to its previous trading band at between 1,430 points to 1,450 points as I believe the European Central Bank will move swiftly to stamp out concerns and restore confidence in the banking system.

The US bond market has more or less stabilized following last week’s massive rally. As expected, the bond market had already factored in the 25 basis points rate hike and are already looking ahead towards a final rate hike in May 2023 followed by rate cuts in 2024. This also helps to stabilize the MGS market in Malaysia. Therefore, I expect the MGS yields to trade within a +/-10 basis points range in the coming week.

Given the fact that the Ringgit has strengthened sharply against the US Dollar over the past two weeks and regained all of its losses over the past month, it is likely to trade within RM4.38 to RM4.48 in the coming week as I expect volatility to slow down.

There is a strong technical support level of between RM4.38 to RM4.40 and I suspect the Ringgit would trade near that level in the short term barring any further deterioration in the global banking sector. - DagangNews.com

Manokaran Mottain has been an economist with a number of financial institutions and is now managing his own firm, Rising Success Consultancy Sdn Bhd and has been writing his economic analysis on a weekly basis in DagangNews.com since 2022.